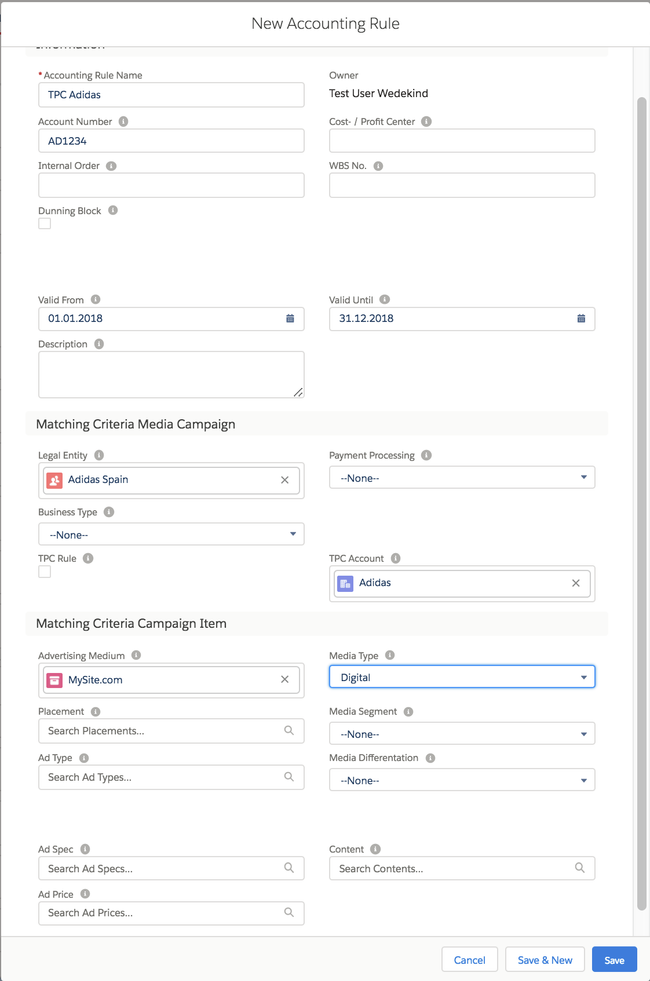

Third Party Commission (TPC) Accounting rules are a special type of 6.5.1 Accounting Rules which are used to define which account payable needs to be assigned for revenue created for a certain third party account/company.

This rule will then indicate which account number or internal order or other bookkeeping indicator the accruals/provision for this TPC needs to be assigned to.

| Info | ||

|---|---|---|

| ||

You can now define Revenue Account Rules and Revenue Distribution Rules as TPC Rules. Previously only Invoice Rules were supported. |

Amount Calculation

TPC Invoice Rules

If you define a TPC Invoice Rule the amount N3-N2 will be calculated and used.

TPC Revenue Account and TPC Revenue Distribution Rules

If you use TPC Rules for Revenue Distribution following amounts will be used:

- You get one Accounting Record with Amount N2 for the Revenue Account

- One Accounting Record with Amount N3 for the Revenue Distribution

- One Accounting Record with the difference between N2 and N3 for the TPC Account

By default the process will use the Amount Field set in the Feature Setting "InvoiceItemAmountField" for TPC Revenue Account and TPC Revenue Distribution Rules. If you want to use another Amount Field for TPC Revenue Distribution Rules your Admin has to add a Feature Setting record "InvoiceItemAmountFieldRevenueDistribution" and set the desired Amount Field.

You can find more information about Feature Settings here: 7.6.8.1 Feature Settings for the Accounting Interface