Value-added tax (VAT) or goods and services tax (GST)

| Version | 2.80 and up(Country configuration) |

|---|---|

| Version | 2.116 and up(State configuration) |

...

VAT can be set up to cover a combination of different situations, Country to Country, State to State within one Country, State to State across boarders etc. Once set up and configured according to the Administrative Instructions (7.6.2.1 Configure the VAT / GST Calculation), VAT relevant information can be be seen on objects throughout your Inventory.

| Table of Contents |

|---|

1. Ad Spec

Read here how to 3.2.4 Enter the VAT type on your AdSpecs.

2. Media Campaign

We have synchronized and automated the processes by which VAT settings are applied to your Media Campaigns. Once Campaign Items have been added to your Media Campaign using the Media Configuration, or thereafter, VAT relevant information is added to or changed on your Media Campaign, the applicable VAT setting is automatically applied/updated. Your proposals will then show the exact tax data which will later be invoiced.

...

* new fields in 2.116

| Info | ||

|---|---|---|

| ||

Create items as VAT Exempt: If you mark this checkbox ALL newly created Campaign Items for this Media Campaign are also set to be VAT Exempt. This will not influence already existing Items. So make sure to manually edit those if needed. Where items are created as VAT exempt, the PDFs will display the following disclaimer 'Tax debtor is the beneficiary.' |

2.a Campaign Item

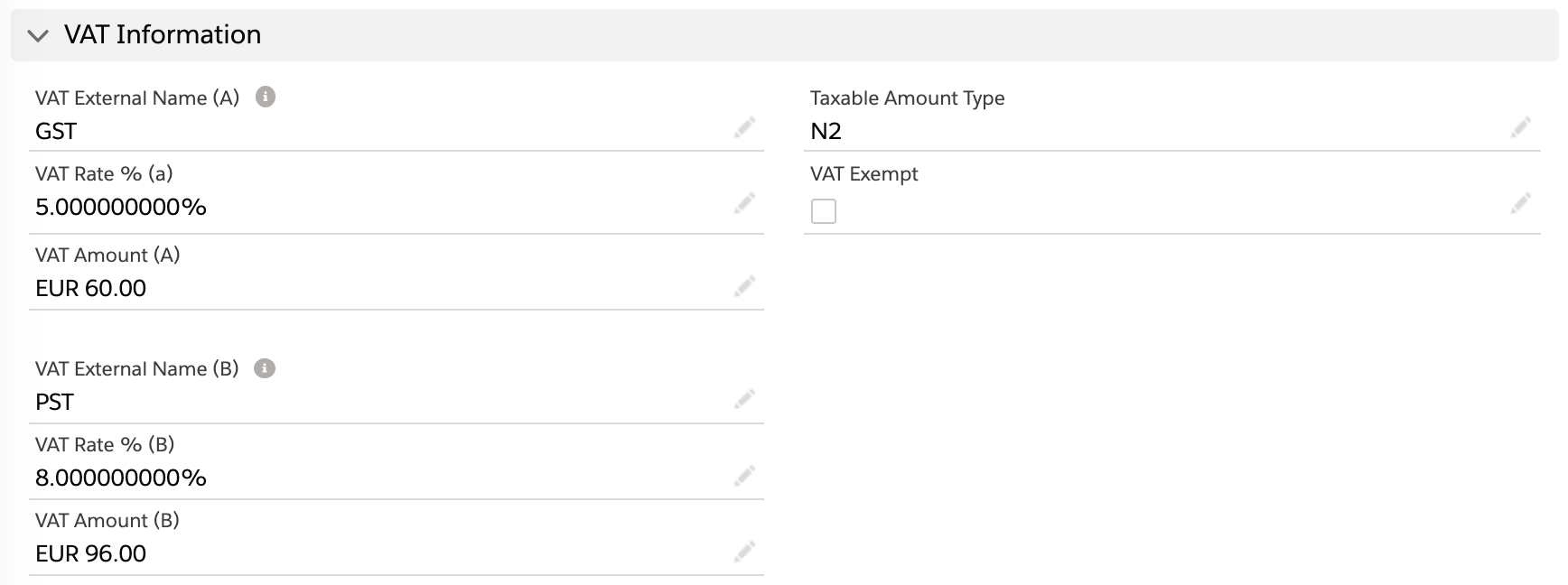

Each line item also carries its own tax information.

...

The tax rate is defined by the VAT type of the AdSpec and the custom VAT settings which are dependant on the seller and buyer of the Media Campaign. The VAT amount gets calculated by multiplying the N2 (default or the defined taxable type) with the rate.

3. Invoice

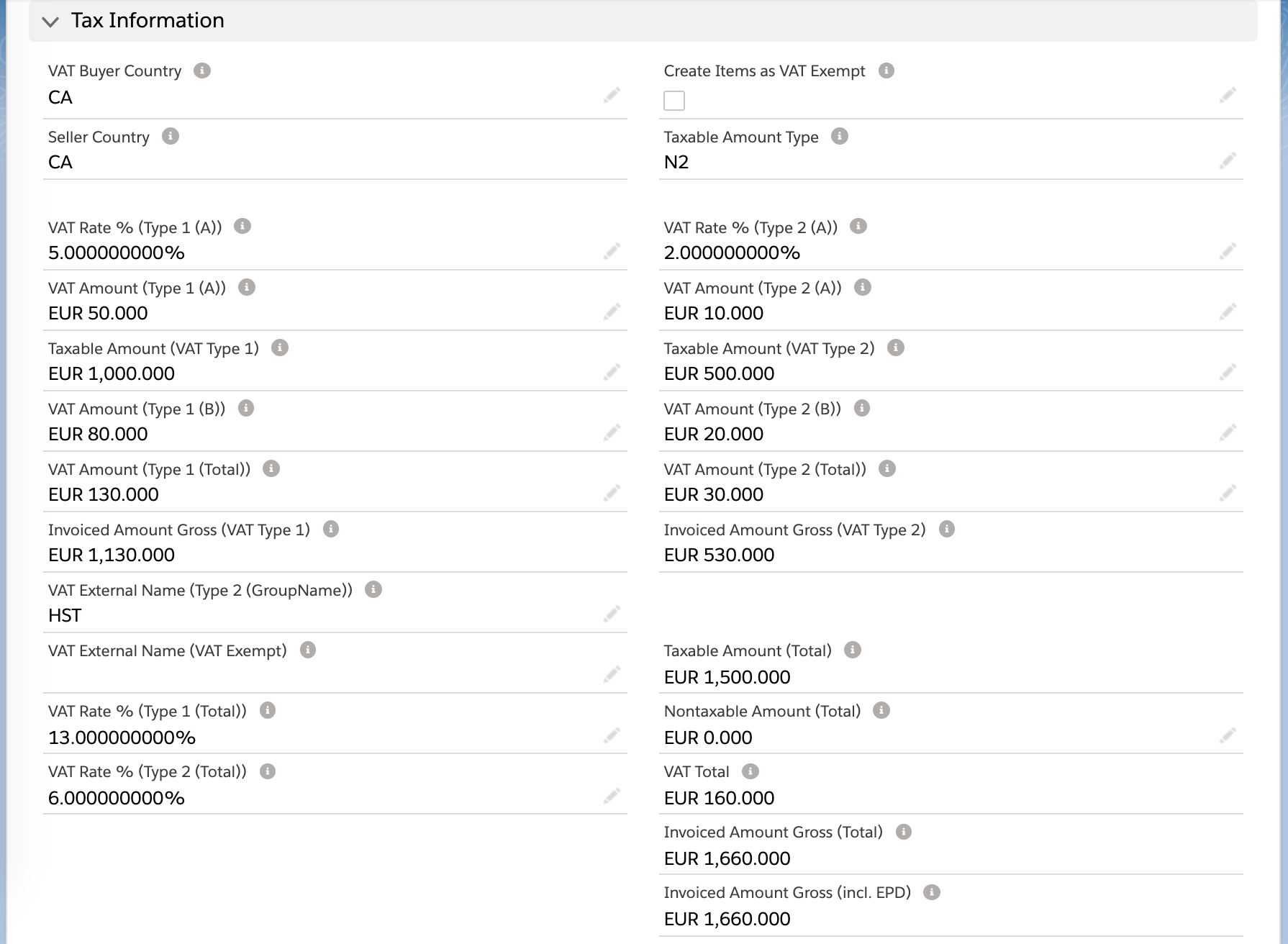

The Invoice contains all VAT data from all Invoice Items. The VAT information summarizes all existing Invoice Items grouped by the normal(1) and reduced(2) VAT rates.

...

| Info | ||

|---|---|---|

| ||

| VAT Exempt (Invoice) is overriding the VAT Exempt (Invoice Item). |

3.a Invoice Item

The Invoice Items contain information from Campaign Items, custom VAT settings and relevant VAT Buyer/Seller (Media Campaign).

...

VAT Rate B available from 2.116 and up

4. Displaying VAT on your Quotes and Invoices

In order to display your VAT on your quotes and invoices, you need to ensure that your preferences are configured correctly.

...