Value-added tax (VAT) or goods and services tax (GST)

| Version | 2.80 and up(Country configuration) |

|---|---|

| Version | 2.116 and up(State configuration) |

Here is how to do to it: Set up your AdSpecs according to your tax requirements. ADvendio currently supports two VAT/GST rates which are called type 1 (normal) and type 2 (reduced). If you only use one rate you can just use type 1 on all of your items that are taxed. Please also follow the Administrative instructions 7.6.2.1 Configure the VAT / GST Calculation.

VAT/GST can be set up to cover a combination of different situations, Country to Country, State to State within one Country, State to State across boarders etc. Once set up and configured according to the Administrative Instructions (7.6.2.1 Configure the VAT / GST Calculation), VAT/GST relevant information can be be seen on objects throughout your Inventory.

...

We have synchronized and automated the processes by which VAT/GST settings are applied to your Media Campaigns. Once Campaign Items have been added to your Media Campaign using the Media Configuration, or thereafter, VAT/GST relevant information is added to or changed on your Media Campaign, the applicable VAT/GST setting is automatically applied/updated. Your proposals will then show the exact tax data which will later be invoiced.

...

When creating Media Campaigns which you expect VAT/GST to be applied to, ensure that you:

- Fill the legal entity if applicable (otherwise the sellers country/state is your salesforce Org country)

- Fill in the field for the VAT/GST debtor and make sure the billing address is well-kept (default VAT/GST Debtor is the Media Campaign Debtor, however this can be configured. See configure the VAT/GST calculation

- Add campaign items.

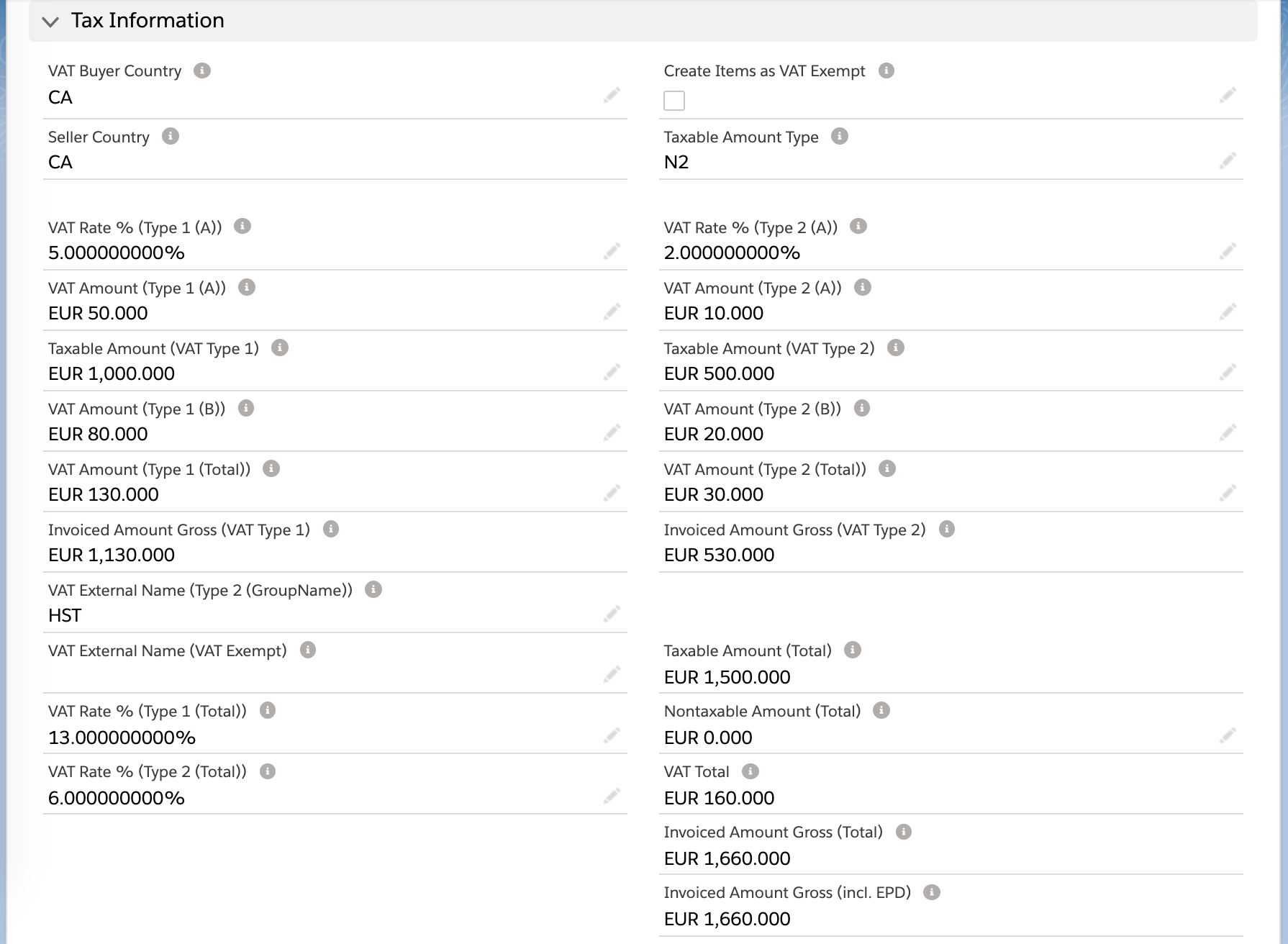

Which fields are populated on Media Campaign level depend on 1) the type of VAT/GST items in the Media Campaign and 2) the VAT/GST settings which are applied.

| Info | ||

|---|---|---|

| ||

In the following text, only VAT is written. VAT is used here as a placeholder and GST can be used instead. All field names in which VAT occurs can also be renamed accordingly with very little effort. |

Field Descriptions:Anchor VAT Field Descriptions VAT Field Descriptions

...

* new fields in 2.116

| Info | ||

|---|---|---|

| ||

Create items as VAT/GST Exempt: If you mark this checkbox ALL newly created Campaign Items for this Media Campaign are also set to be VAT/GST Exempt. This will not influence already existing Items. So make sure to manually edit those if needed. Where items are created as VAT exempt, the PDFs will display the following disclaimer 'Tax debtor is the beneficiary.' |

2.a Campaign Item

Each line item also carries its own tax information.

...