Collection Accounting Rules operate to collect the cost/revenue for the Invoice Items to which they apply to the relevant cost centers.

| Info |

|---|

One campaign item record will be reflected in one accounting record including all its information on debtor and payment terms, etc. For accounting records type 'revenue' amount equals N2, whereas accounting records type 'cost' uses TpcAmount. |

There are two different types of Collection Rules

- Collection - Cost - this is used to define the rules for cost collection

- Collection - Revenue - this is used to define the rules for revenue collection

Set up your Collection Rule

In order to create a rule, you need only to give your rule a name. To ensure the rule creates the correct Accounting Record and it is matched to the correct Invoice Item, you can optionally enter the following:

- Account Number, Cost Center, Internal Order, etc

- A validity period

- If this is a Third Party Rule, please enter a TPC Account

- The applicable Publisher Payout Condition

Dunning Block - check this checkbox if you like to block dunning for a rule. This field gets also copied into your Accounting Record

Optionally, you can also add a description

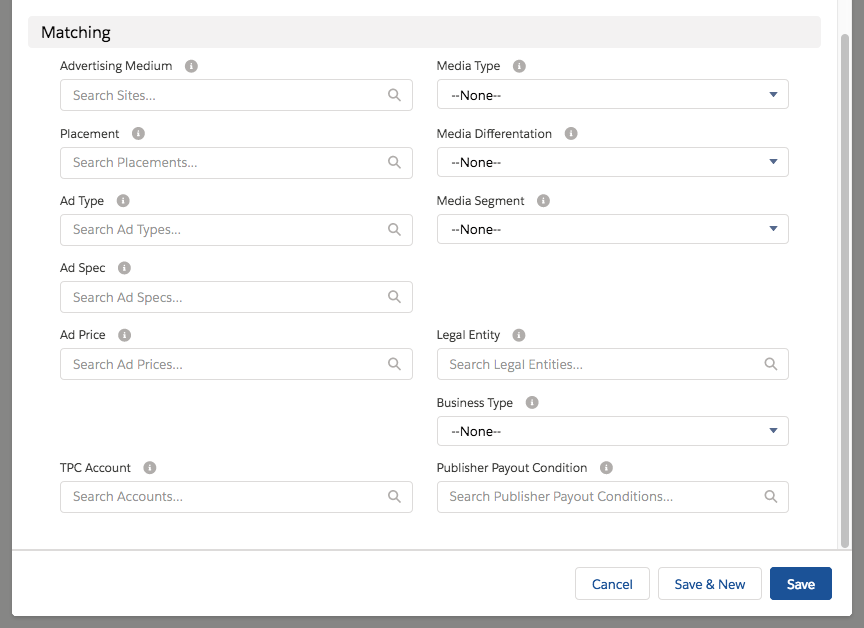

Define the Matching Criteria

Here you can define the relevant matching criteria for your rule. Read more in the Accounting Interface Matching & Transfer Fieldlist.

Accounting Rules are used in the following processes

...