Version 2.112 and up

Accounting Rules are a very flexible objects to store your accounting system information and use this to create records with the information pre-populated, ready to transfer to your ERP and accounting system. They describe your account determination procedure for internal cost centers, expense and revenue accounts. Therefore you can post subsequent costs and revenue by debtor no, amount, Terms of Payment, VAT, or any other external ids to be used for your revenue distribution.

It is assumed that each accounting rule in regard to all combination of fields used as Rule-Matching-Criterion is unique within all defined rules.

It is important NOT to change accounting rules once they are used in the automated accounting interface process. The only fields you change after active are the valid from and until fields.

Accounting rules can not be deleted once there are related Accounting Records.

Accounting Rules describe your business rules so that depending on what you sell it gets assigned to the correct account:

General Ledger Code (GL Code),

WBS code,

cost center,

profit center,

Account Number or

other.

Inventory can be matched by a number of different criteria which is set out in the different Accounting rules and which depends on the process that is being run. These rules can then be used to (automatically) create Accounting Records which feed into standard accounting interfaces.

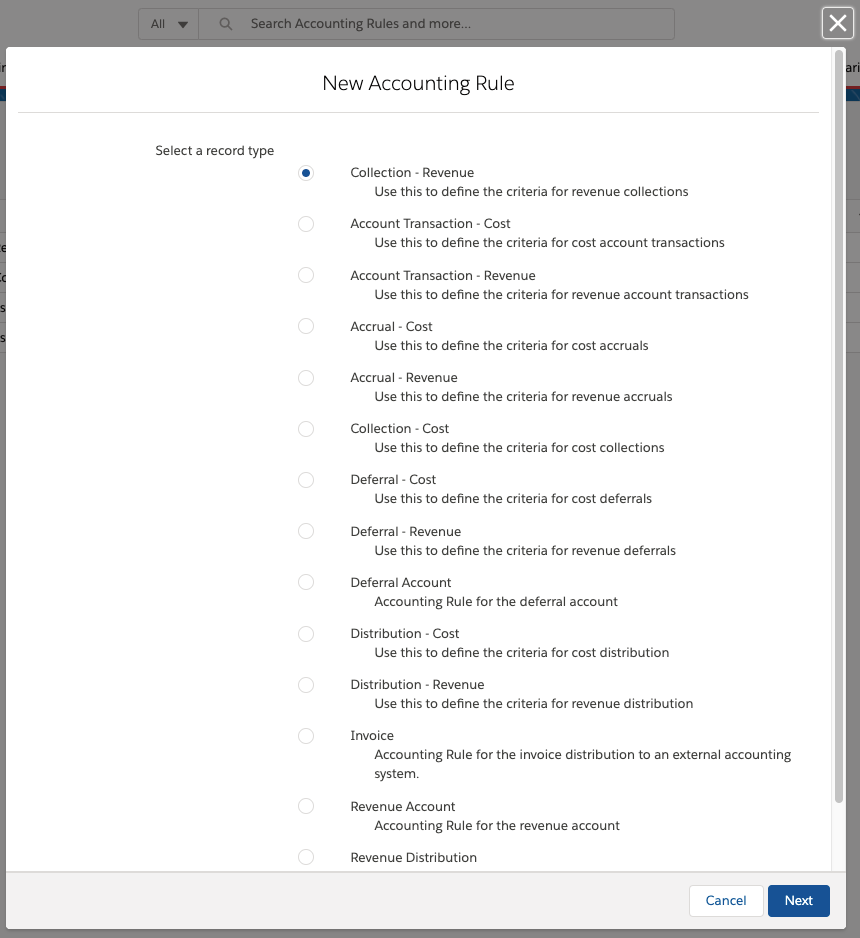

You can create ten different types of Accounting Rules, which will create the relevant Accounting Records when used in the Accounting Records Creation Processes . These rules are

Account Transaction - Cost

Account Transaction - Revenue

Accrual - Cost

Accrual - Revenue

Collection - Cost

Collection - Revenue

Deferral - Cost

Deferral - Revenue

Distribution - Cost

Distribution - Revenue

When to choose which type?

Accounting Rule - Record Type | Source Record | Use Cases | Accounting Record Type ADvendio__DebitCredit__c | Comment |

|---|---|---|---|---|

Account Transaction - Cost | Invoice Item | |||

Account Transaction - Revenue | Invoice Item | |||

Accrual - Cost | Campaign Item | Used to recognize certain expenses now that have not yet been invoiced or paid. Each item can be sent to a different accrual account. | Creditor / Debtor (accounts payable / receivable account) | |

Accrual - Revenue | Campaign Item | Used to recognize certain revenue now that have not yet been invoiced or paid. Each item can be sent to a different accrual account. | Debtor (accounts receivable account) | |

Collection - Cost | Invoice Item | Used to split invoice items into several accounts for cost collection. | ||

Collection - Revenue | Invoice Item | Used to split invoice items into several accounts for cost collection. | ||

Deferral - Cost | Invoice Item | Used to delay recognizing certain expenses on the statements until a later time. Each item can be sent to a different deferral account. | Creditor / Debtor (accounts payable / receivable account) | |

Deferral - Revenue | Invoice Item | Used to delay recognizing certain revenues or expenses on the statements until a later time. Each item can be sent to a different deferral account. | Creditor / Debtor (accounts payable / receivable account) | |

Distribution - Cost | Invoice Item | Used to split invoice items into several accounts for cost distribution. Especially important for rotation products etc. Make sure to mark the Delivery Data Based Revenue Distribution checkbox on the AdSpec if needed. | Debtor (accounts payable account) | |

Distribution - Revenue | Invoice Item | Used to split invoice items into several accounts for revenue distribution. Especially important for rotation products etc. Make sure to mark the Delivery Data Based Revenue Distribution checkbox on the AdSpec if needed. | Creditor (accounts payable account) |