6.4.3 Cancellation and Accounting Records

Version 2.115 and up

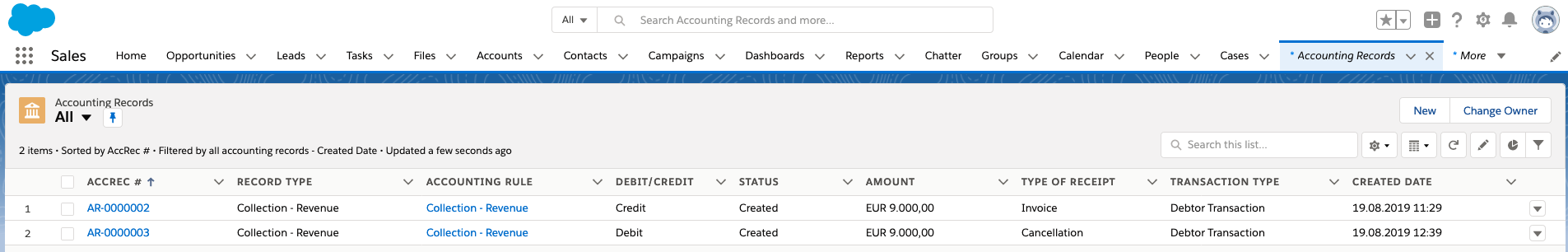

Use Case 1

- Invoice a Campaign Item

- Create Accounting Records

- Cancel a Campaign or Invoice Item and invoice the Cancellation

Results:

Collection & Distribution: When Accounting Records have already been created for an Item which is subsequently cancelled, cancellation records will be created on the next run of the relevant process.

Accrual and Deferral: When accrual or deferral records have been created for an Item which is subsequently cancelled, cancellation records will be created so long as the original accrual or deferral hasn't been reversed. If the original accrual or deferral has been reversed in the meantime, a Cancellation Accounting Record is not needed.

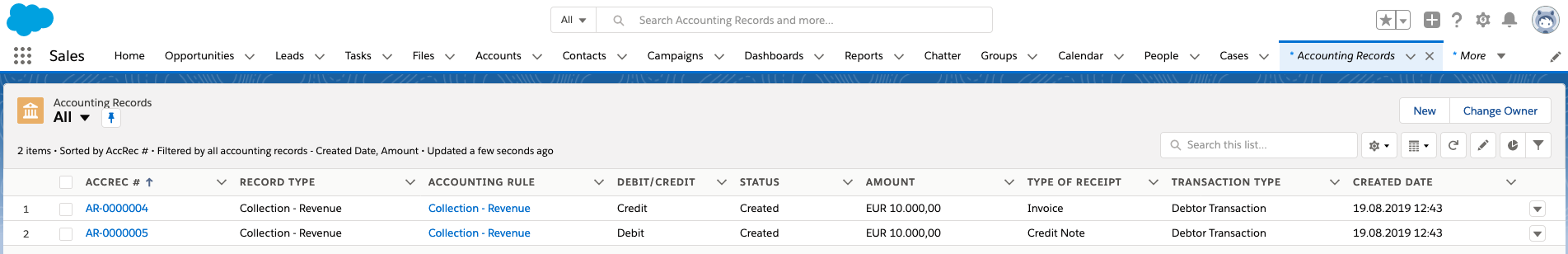

Use Case 2:

- Invoice a Campaign Item

- Cancel this Campaign Item or Invoice and invoice the Cancellation

- Create Accounting Records

Results:

Collection & Distribution: When an Item has been cancelled and has not yet had any Accounting Records created, on the next run of the relevant process, both the original and cancellation Accounting Records will be created.

Accrual and Deferral: When an Item has been cancelled and has not yet had any Accounting Records created, on the next run of the Accrual or Deferral processes, no Accounting Records will be created.